by Boris Benic | Mar 5, 2019 | Blog

March 5, 2019

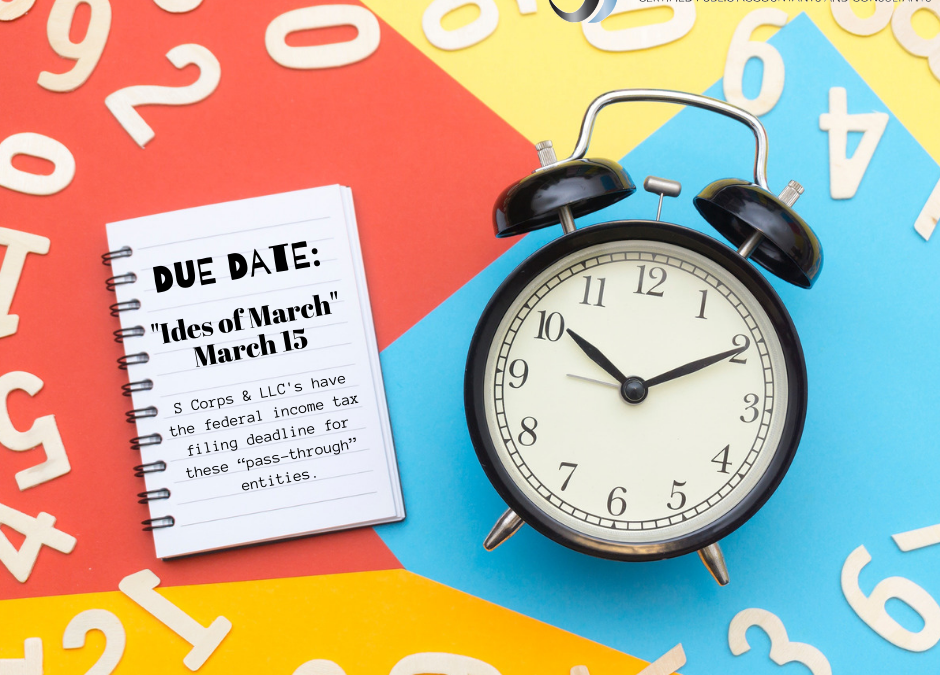

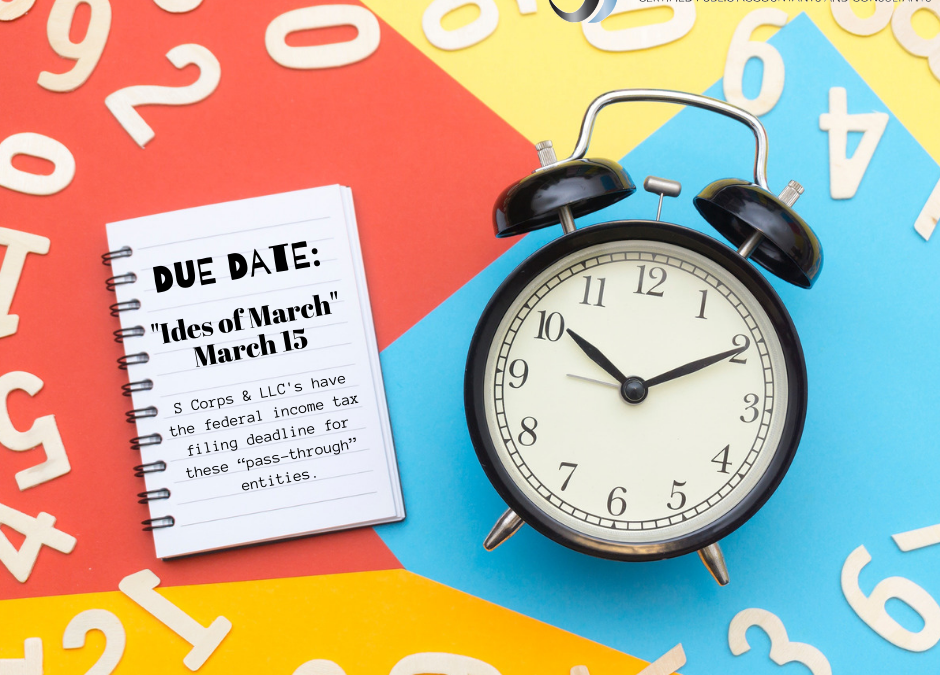

Shakespeare’s words don’t apply just to Julius Caesar; they also apply to calendar-year partnerships, S corporations and limited liability companies (LLCs) treated as partnerships or S corporations for tax purposes. Why? The Ides of March, more commonly known as March 15, is the federal income tax filing deadline for these “pass-through” entities.

(more…)

by Boris Benic | Feb 26, 2019 | Blog

February 26, 2019

While the Tax Cuts and Jobs Act (TCJA) reduces most income tax rates and expands some tax breaks, it limits or eliminates several itemized deductions that have been valuable to many individual taxpayers. Here are five deductions you may see shrink or disappear when you file your 2018 income tax return:

(more…)

by Boris Benic | Feb 21, 2019 | Blog

Want to know one thing corporate executives and business owners have always known? Business is about networking. It’s vital for building, fostering, and maintaining the types of strong relationships necessary for sustaining and growing a healthy business.

(more…)

by Boris Benic | Feb 19, 2019 | Blog

February 19, 2019

When you file your 2018 income tax return, you’ll likely find that some big tax law changes affect you — besides the much-discussed tax rate cuts and reduced itemized deductions. For 2018 through 2025, the Tax Cuts and Jobs Act (TCJA) makes significant changes to personal exemptions, standard deductions and the child credit. The degree to which these changes will affect you depends on whether you have dependents and, if so, how many. It also depends on whether you typically itemize deductions.

(more…)

by Boris Benic | Feb 12, 2019 | Blog

February 12, 2019

The IRS opened the 2018 income tax return filing season on January 28th. Even if you typically don’t file until much closer to the April 15 deadline, this year consider filing as soon as you can. Why? You can potentially protect yourself from tax identity theft — and reap other benefits, too.

(more…)

by Boris Benic | Feb 5, 2019 | Blog

February 5, 2019

Commercial buildings and improvements generally are depreciated over 39 years, which essentially means you can deduct a portion of the cost every year over the depreciation period. (Land isn’t depreciable.) But special tax breaks that allow deductions to be taken more quickly are available for certain real estate investments.

(more…)