by Boris Benic | Jun 26, 2018 | Blog

June 26, 2018

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2018. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

(more…)

by Boris Benic | Jun 19, 2018 | Blog

June 19, 2018

The massive changes the Tax Cuts and Jobs Act (TCJA) made to income taxes have garnered the most attention. But the new law also made major changes to gift and estate taxes. While the TCJA didn’t repeal these taxes, it did significantly reduce the number of taxpayers who’ll be subject to them, at least for the next several years. Nevertheless, factoring taxes into your estate planning is still important.

(more…)

by Boris Benic | Jun 12, 2018 | Blog

June 12, 2018

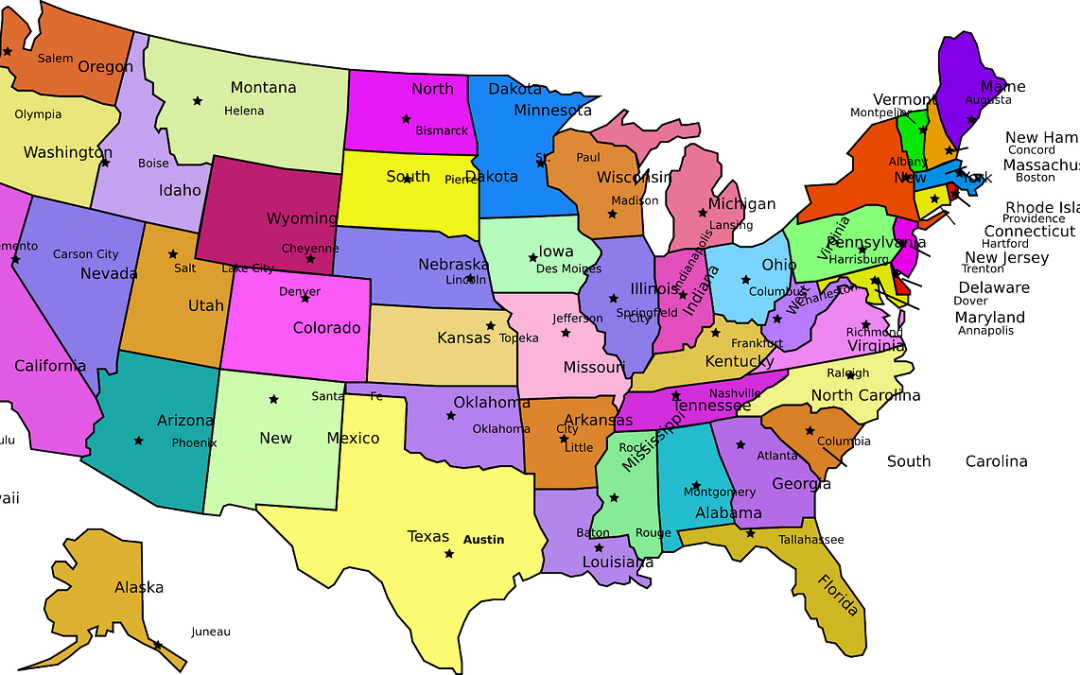

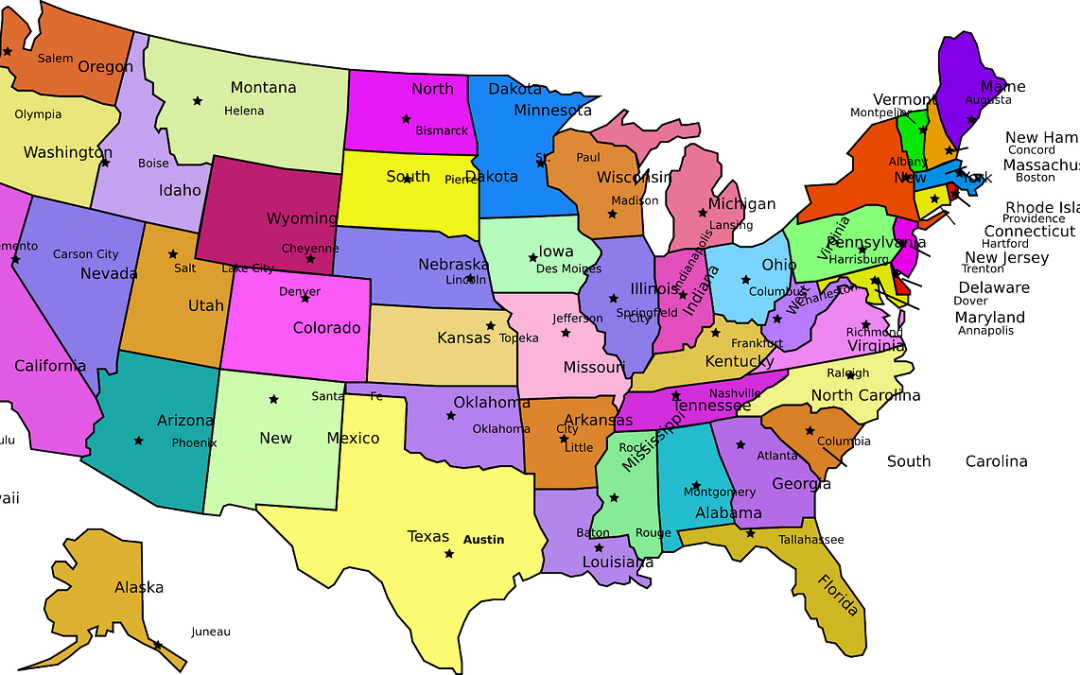

Many Americans relocate to another state when they retire. If you’re thinking about such a move, state and local taxes should factor into your decision.

(more…)

by Boris Benic | Jun 5, 2018 | Blog

June 5, 2018

Today many employees receive stock-based compensation from their employer as part of their compensation and benefits package. The tax consequences of such compensation can be complex — subject to ordinary-income, capital gains, employment and other taxes. But if you receive restricted stock awards, you might have a tax-saving opportunity in the form of the Section 83(b) election.

(more…)

by Boris Benic | May 29, 2018 | Blog

May 29, 2018

It’s not uncommon for businesses to sometimes generate tax losses. But the losses that can be deducted are limited by tax law in some situations. The Tax Cuts and Jobs Act (TCJA) further restricts the amount of losses that sole proprietors, partners, S corporation shareholders and, typically, limited liability company (LLC) members can currently deduct — beginning in 2018. This could negatively impact owners of start-ups and businesses facing adverse conditions.

(more…)

by Boris Benic | May 22, 2018 | Blog

May 23, 2018

In many parts of the country, summer is peak season for selling a home. If you’re planning to put your home on the market soon, you’re probably thinking about things like how quickly it will sell and how much you’ll get for it. But don’t neglect to consider the tax consequences.

(more…)