by Boris Benic | Dec 26, 2018 | Blog

December 26, 2018

Do you have investments outside of tax-advantaged retirement plans? If so, you might still have time to shrink your 2018 tax bill by selling some investments you just need to carefully select which investments you sell.

(more…)

by Boris Benic | Dec 24, 2018 | Blog

December 20, 2018

In the past, online retailers were only required to collect state and city sales tax in states where they had a physical presence, such as a warehouse, employees, or an office. But earlier this year, the Supreme Court changed everything for e-commerce companies when they upheld a law permitting states to charge sales tax to out-of-state sellers, regardless of whether or not a business has a physical presence in that state.

(more…)

by Boris Benic | Dec 18, 2018 | Blog

December 18, 2018

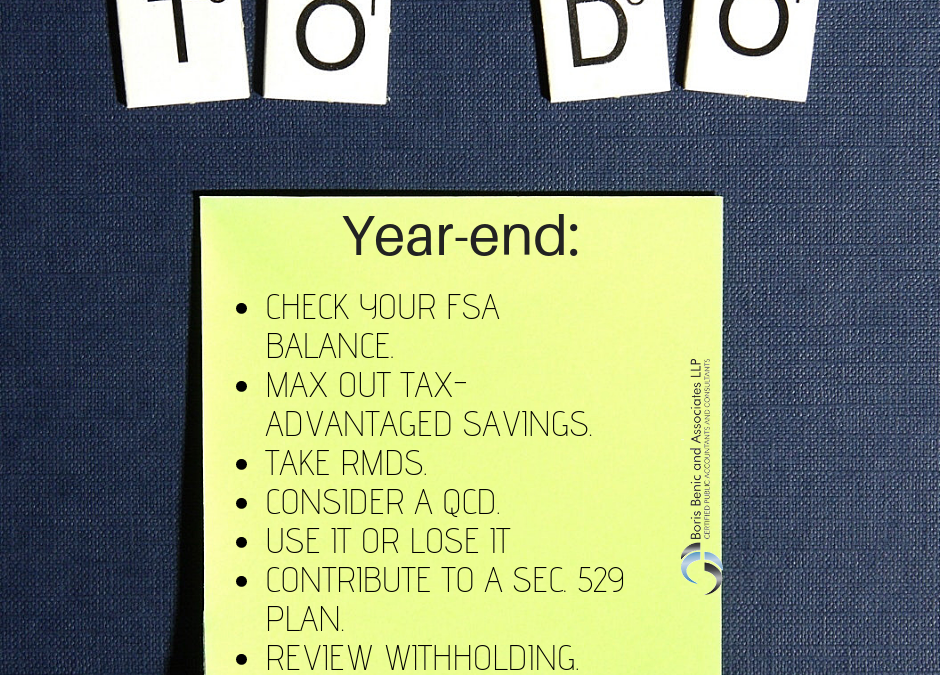

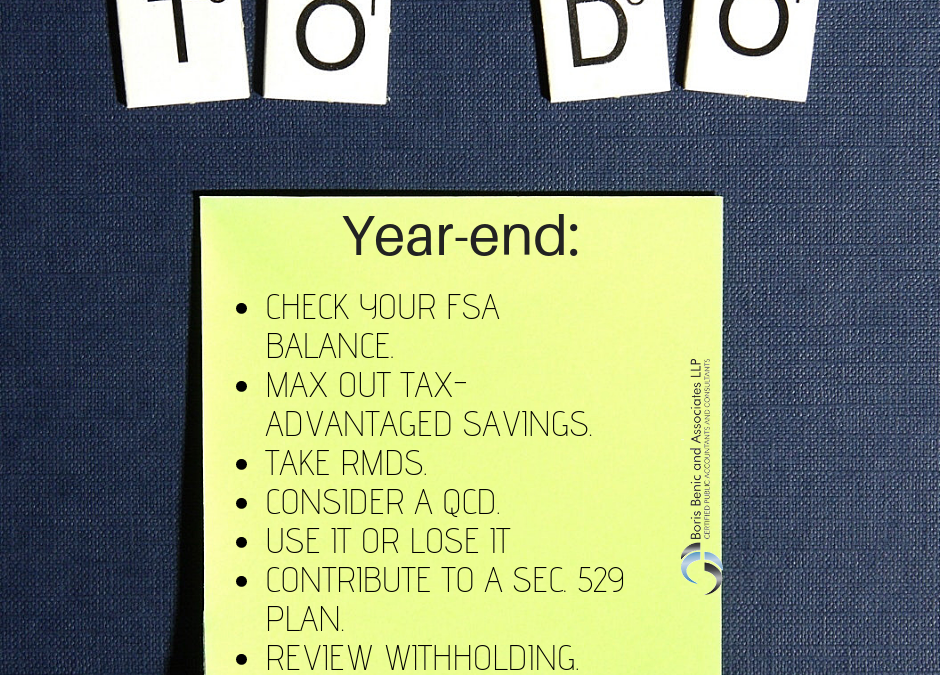

With the dawn of 2019 on the near horizon, here’s a quick list of tax and financial to-dos you should address before 2018 ends: (more…)

by Boris Benic | Dec 11, 2018 | Blog

December 11, 2018

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2019. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

(more…)

by Boris Benic | Dec 4, 2018 | Blog

December 4, 2018

Prepaying property taxes related to the current year but due the following year has long been one of the most popular and effective year-end tax-planning strategies. But does it still make sense in 2018?

(more…)

by Boris Benic | Nov 29, 2018 | Blog

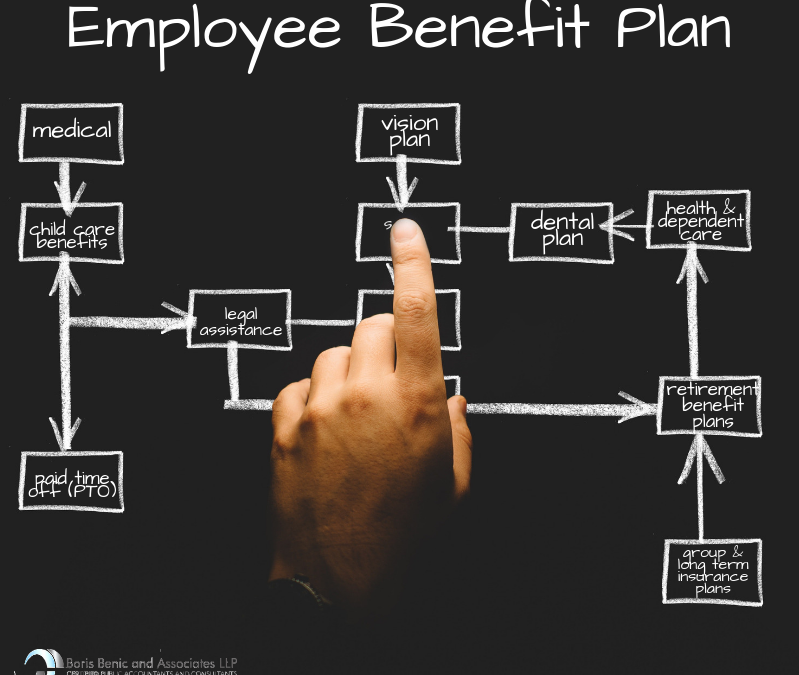

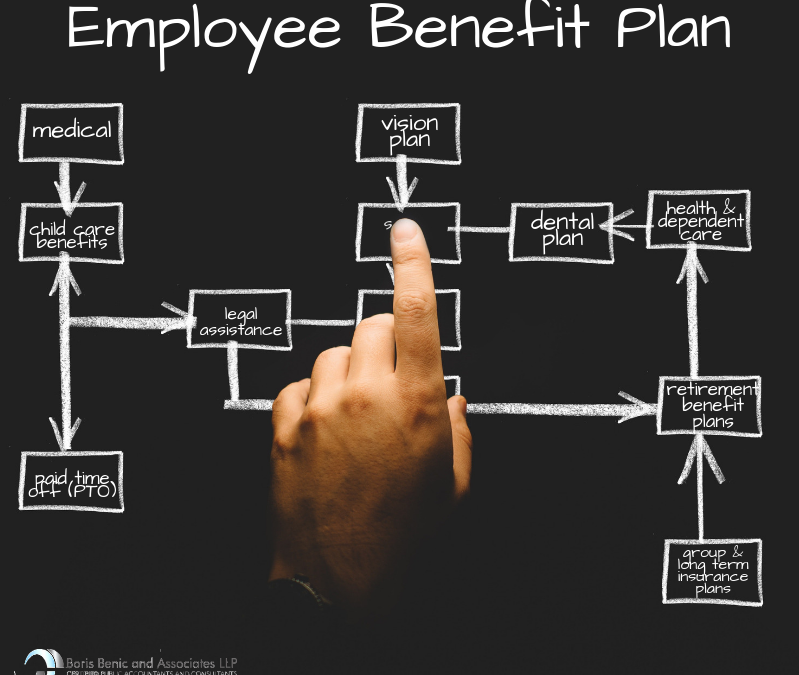

In 2015, the Employee Benefits Security Administration reported that 39% of annual audits of plan financial statements contained major deficiencies to one or more applicable requirements. The rules for employee benefit plans audits are complex, which is why the importance of hiring experienced employee benefit plan auditors cannot be understated. (more…)